Liberalized Remittance Scheme (LRS): Unlocking Financial Freedom for Indian Residents

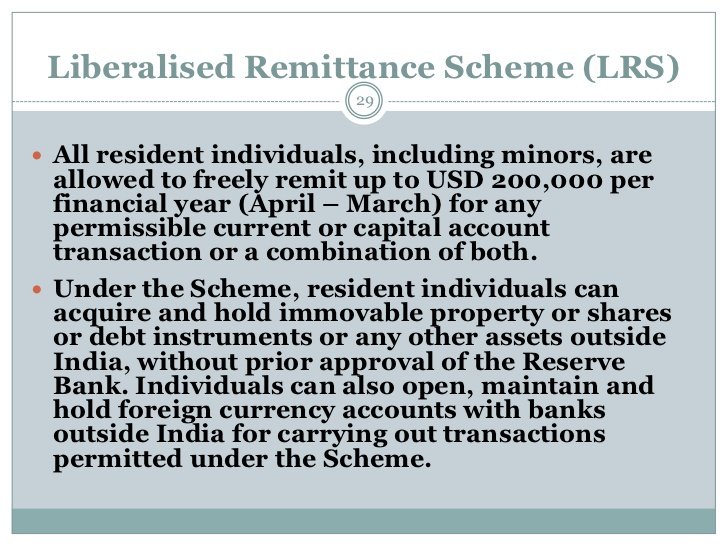

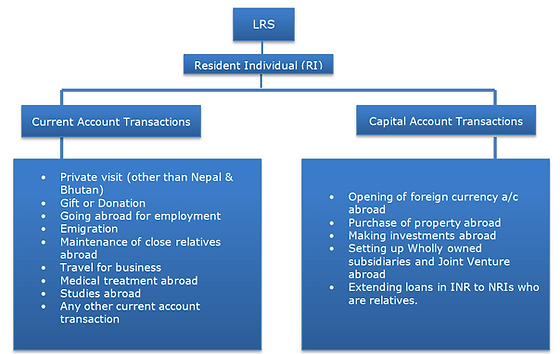

Liberalized Remittance Scheme:The Liberalized Remittance Scheme (LRS) had recently introduced by the Reserve Bank of India (RBI) enables Indian residents to freely transfer funds abroad for specific purposes. This scheme has recently undergone an amendment that includes credit card transactions within the LRS limit of $250,000 per financial year starting from July 1. This change aims to prevent the misuse of credit cards to bypass LRS restrictions, requiring individuals to plan their foreign remittances carefully. Under the LRS, residents can remit funds abroad within the annual limit of $250,000 per individual, covering various permissible transactions such as investments, education expenses, travel, and gifting to relatives abroad. Certain transactions like gambling and margin trading are prohibited. The LRS provides financial autonomy to diversify investments, pursue education abroad, and enhance travel experiences.

Liberalized Remittance Scheme

Liberalized Remittance Scheme: Key Features and Limits

Impact on the Indian Economy:

The LRS has had several positive outcomes for the Indian economy. It has boosted foreign exchange reserves, attracted foreign investments, facilitated business expansion and entrepreneurship, and promoted knowledge and skill transfer. The scheme also strengthens the Indian financial system through transparent monitoring of cross-border transactions.

Challenges and Considerations:

While the LRS offers benefits, individuals should be aware of exchange rate risks, ensure regulatory compliance, exercise prudent financial planning, and maintain proper documentation. The RBI closely monitors remittances to prevent illicit activities.

The LRS offers the following key features and limits:

- Monetary Limits:

The LRS sets an annual limit of $250,000 per individual per financial year for all permissible transactions combined. - Eligible Transactions:

The LRS covers a wide range of transactions, including:

- Investment in stocks, bonds, and properties overseas

- Acquisition of shares in foreign companies

- Setting up wholly-owned subsidiaries and joint ventures abroad

- Gifting to relatives outside India

- Medical treatments abroad

- Education expenses

- Travel for tourism purposes

- Prohibited Transactions:

Certain transactions are not permitted under the LRS, including remittances for gambling or lottery purposes, margin trading, or any other activity prohibited under the Foreign Exchange Management Act (FEMA).

Impact on the Indian Economy:

The LRS has had several positive outcomes for the Indian economy. It has boosted foreign exchange reserves, attracted foreign investments, facilitated business expansion and entrepreneurship, and promoted knowledge and skill transfer. The scheme also strengthens the Indian financial system through transparent monitoring of cross-border transactions.

Challenges and Considerations:

While the LRS offers benefits, individuals should be aware of exchange rate risks, ensure regulatory compliance, exercise prudent financial planning, and maintain proper documentation. The RBI closely monitors remittances to prevent illicit activities.

Table: Permissible Purposes and Limits under the Liberalized Remittance Scheme (LRS)

| Permissible Purposes | Limit per financial year |

|---|---|

| Education | Up to $250,000 |

| Medical Treatment | Up to $250,000 |

| Travel | Up to $250,000 |

| Investments | Up to $250,000 |

| Purchase of Property | Up to $250,000 |

| Gifting | Up to $250,000 |

| Maintenance of Relatives | Up to $250,000 |

Liberalized Remittance Scheme: Conclusion

The Liberalized Remittance Scheme has empowered Indian residents by providing greater financial freedom and access to global opportunities. It has positively impacted the Indian economy by bolstering foreign exchange reserves, attracting investments, and fostering entrepreneurship. However, individuals must exercise caution, comply with regulations, and make informed decisions while utilizing the scheme. The LRS continues to play a vital role in personal growth and the country’s economic progress in an interconnected world

What is the Liberalized Remittance Scheme?

A: The Liberalized Remittance Scheme (LRS) is a facility provided by the RBI that allows Indian residents to transfer funds abroad for specific purposes within defined limits.

What are the key features of the LRS?

A: The LRS has an annual limit of $250,000 per individual and covers various transactions such as investments, education expenses, travel, and gifting to relatives abroad.

- Marathi Sexy Girl Bike Riding Video: Watch Now

- Germany Faces Recession as Economy Contracts Unexpectedly

- TATA IPL 2023: क्या इस बार मिलेगा आईपीएल को नया चैंपियन , या फिर चैंपियन टीमें ही फिर मारेंगी बाजी

- CTTC Bhubaneswar Recruitment Notification: Various Posts Available

- Uppena fame Krithi Shetty had high hopes for Manamey, after multiple failed movie character